The dynamic and rapidly evolving landscape of the cryptocurrency market has captivated the attention of investors and enthusiasts alike. Within this realm, the listing of a cryptocurrency on various exchanges stands out as a pivotal moment, capable of influencing its price trajectory and market dynamics. Cryptocurrency exchanges serve as the lifeblood of the digital asset ecosystem, providing platforms for trading, liquidity, and, most notably, exposure to a broader audience of potential investors. As we delve into the intricate interplay between exchange listings and crypto coin prices, it becomes imperative to explore the multifaceted factors that contribute to this relationship.

The Significance of Exchange Listings

Cryptocurrency exchanges, the bustling marketplaces where digital assets change hands, play a pivotal role in shaping the trajectory of cryptocurrency prices. These platforms, varied in nature and functionality, serve as the linchpin connecting buyers and sellers in the decentralized realm.

Definition and Types of Cryptocurrency Exchanges:

Cryptocurrency exchanges are online platforms that enable users to buy, sell, and trade various digital assets. There are two primary types: centralized exchanges (CEX) and decentralized exchanges (DEX). Centralized exchanges operate with a central authority, facilitating user interactions, while decentralized exchanges leverage smart contracts and blockchain technology to enable peer-to-peer trading without the need for a central authority.

Role of Exchanges in Facilitating Liquidity and Trading:

Liquidity, the ease with which an asset can be bought or sold, is fundamental to market efficiency. Exchanges act as catalysts for liquidity by providing a venue where buyers and sellers converge. The more liquid an asset, the more efficiently it can be traded, reducing price volatility and enhancing overall market stability.

Access to a Wider Investor Base through Exchange Listings:

Exchange listings are transformative moments for cryptocurrencies, expanding their reach to a broader audience of potential investors. When a coin is listed on a prominent exchange, it gains increased visibility and accessibility. This heightened exposure not only attracts individual investors but also institutional players, fostering a more diverse and robust investor base.

Factors Influencing Price Movements

Understanding the intricate dance of factors that influence cryptocurrency prices is essential for investors navigating the dynamic crypto market. The impact of exchange listings on these prices is nuanced, shaped by various elements that extend from initial reactions to broader, long-term considerations.

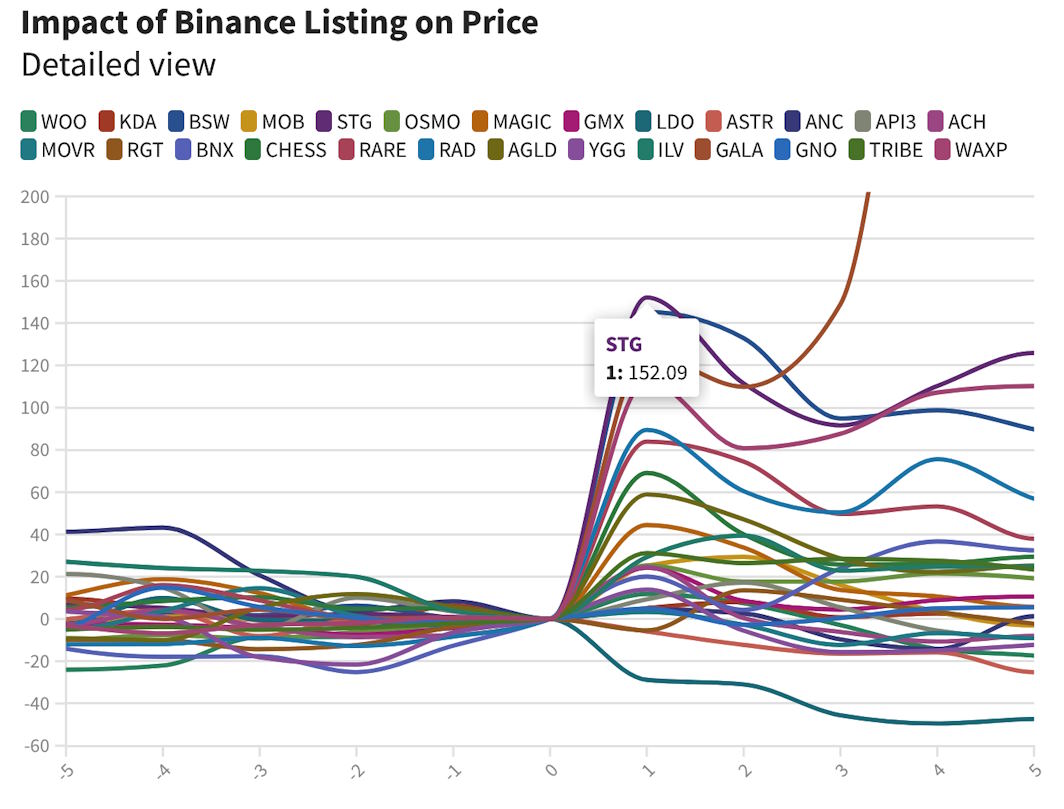

Initial Price Reactions to Exchange Listings:

The immediate aftermath of a cryptocurrency being listed on an exchange is often marked by volatility. Traders and investors react swiftly to the newfound accessibility of the digital asset, resulting in sharp price movements. These initial reactions can set the tone for the coin’s short-term trajectory, creating both opportunities and challenges for market participants.

Market Sentiment and Perception:

The sentiment surrounding a cryptocurrency is a powerful determinant of its price movements. Positive perceptions of a coin’s technology, utility, or future potential can lead to increased demand and higher prices. Conversely, negative sentiment can trigger sell-offs and price declines. Exchange listings, by elevating a coin’s visibility, significantly influence market sentiment and, subsequently, its valuation.

Trading Volume and Liquidity Changes:

One of the immediate impacts of exchange listings is the alteration of a coin’s trading volume and liquidity. The increased availability of the cryptocurrency on a popular exchange often leads to higher trading volumes. This surge in liquidity can contribute to smoother price movements and enhanced market efficiency.

Impact on Long-Term Value and Sustainability:

While the short-term effects are palpable, the lasting impact of exchange listings on a cryptocurrency’s value and sustainability is equally crucial. Factors such as continued community support, ongoing development, and real-world use cases play a vital role in determining whether the initial price movements are sustainable over the long term.